Know The Law

Gift Deed in Blood Relation | Meaning, Procedure & Benefits

1.2. Who Qualifies As Blood Relatives?

1.3. Is Blood Relation Necessary For A Gift Deed?

2. Key Element Of Gift Deed In Blood Relation2.1. Key Details To Be Included In Gift Deed In Blood Relation

3. Legal Benefits Of Executing A Gift Deed In Blood Relation 4. Step-by-Step Procedure Of Registering A Gift Deed In Blood Relation4.1. How Long Does The Gift Deed Process Take?

5. Stamp Duty Rebates On Gift Deeds For Blood Relatives: State-Wise Benefits in India 6. Gift Deed Registration Charges Based On States 7. Gifting To Blood Relations vs. Non-Relatives 8. Tax Consideration For Gift Deed In Blood Relation 9. Step-by-Step Guide For Gifting Property In Blood Relation With Example 10. Key Factors Affecting Stamp Duty On Gift Deeds 11. Sample Format Of Gift Deed In Blood Relation 12. Conclusion 13. FAQs13.1. Q1. Is a gift given in a blood relation taxable?

13.2. Q2. What is the stamp duty on a GIFT deed in blood relation?

13.3. Q3. What are the characteristics of a Gift Deed in blood relation?

A Gift Deed in Blood Relation is a legally binding document that facilitates the transfer of property—movable or immovable—from one family member (donor) to another (donee) without monetary exchange. Unlike sale deeds, which involve a financial transaction, a gift deed is executed out of love and affection, often between close relatives such as parents, children, siblings, or spouses.

Executing a gift deed among blood relatives comes with multiple legal and financial benefits, including reduced stamp duty, exemption from income tax, and a simplified transfer process. However, understanding the essential elements, legal procedures, and state-wise stamp duty implications is crucial to ensuring a smooth and valid transfer.

In this comprehensive guide, we’ll explore the meaning, benefits, registration process, tax considerations, and state-wise stamp duty rates for a gift deed in blood relation to help you navigate this legal process seamlessly.

Understanding Gift Deed In Blood Relation

A Gift Deed is a legal document that transfers ownership of movable or immovable property from one person (the donor) to another (the donee) without any exchange of money or other valuable consideration.

Meaning And Scope

A Gift Deed is a legal document made to bestow movable or immovable property from one person to another on a gratuitous basis in consideration of love and affection. Though it is a common gift given between blood relatives, it may be accompanied by emotional sentiments, placement of certain conditions, and specific legal provisions due to such a relationship in most jurisdictions. For blood relations, the scope of the Gift Deed solvable includes but is not limited to the following: land and buildings, motor vehicles, shares, and jewelry.

Who Qualifies As Blood Relatives?

The definition of blood relatives includes:

- Children

- Siblings

- Grandparents

- Parents

- Spouses (related by marriage generally)

- Some states also allow specific lineal ascendants and descendants.

Is Blood Relation Necessary For A Gift Deed?

Although a gift deed can be executed between any individuals, it is common to find that relatives have their preferences, especially with regard to stamp duty and tax implications. Still, a gift deed is a legitimate legal contention to transfer property to strangers.

Also Read : What Is A Cash Gift Deed In Blood Relation?

Key Element Of Gift Deed In Blood Relation

A valid Gift Deed must contain the required details so that it is enforced successfully.

Key Details To Be Included In Gift Deed In Blood Relation

The key elements of a gift deed are:

- Full names, addresses, and relationship of the donor and donee.

- A detailed property description covering its location, size, and boundaries.

- Must state that the transfer is voluntary and without consideration, with the donee explicitly accepting the gift.

- Signatures from two witnesses.

- Date and location of execution.

Also Read : Cancellation of a Gift Deed in India

Legal Benefits Of Executing A Gift Deed In Blood Relation

The legal benefits of executing a sale deed are as follows:

- A gift deed ensures the legally recognized and clear ownership transfer of property to the recipient, minimizing the possibility of disputes arising among family members.

- Hence, gifts by blood relations may be exempt from stamp duty or get discounts.

- Besides, proper documentation ensures clarity and security against possible misunderstandings.

- Gift deeds in estate planning are important for the planned and smooth transfer of values from one person to another.

- By making a gift legally binding, the giver can ensure his or her intentions and the gift will go through, which allows for an efficient distribution of assets that minimizes associated legal ambiguities and complexities.

For a hassle-free execution of gift deeds, consult experienced property lawyers who specialize in property transfer laws.

Step-by-Step Procedure Of Registering A Gift Deed In Blood Relation

Follow these steps to register a gift deed in blood relation:

- The first step is to draft the Gift Deed correctly and clearly.

- Stamp it with an appropriate stamp paper value as per the state stamp duty laws. The donor, the donee, and two witnesses must sign the deed.

- After completing the signatures, the Gift Deed has to be registered with the sub-registrar's office having jurisdiction over the property.

- Filing will require the original Gift Deed, along with identification proof and property documents.

- Payment of registration fees will be as per the regulations locally. Complete this process by collecting the registered Gift Deed after verification.

How Long Does The Gift Deed Process Take?

The timeline for the Gift Deed process, however, may vary widely by state and also by the efficiency of the sub-registrar's office. One normally can expect it to take a few days to a few weeks.

Also Read : Procedure To Revoke Or Cancel A Gift Deed In India

Stamp Duty Rebates On Gift Deeds For Blood Relatives: State-Wise Benefits in India

The gift deed registration charges will vary depending on the property's value and the state in which it is situated. These fees are generally in the form of a percentage of the value of the transaction carried for the property, but they vary with each state and the kind of property involved.

Haryana

Starting in 2014, Haryana has provided relief from stamp duty for gift deeds executed in favor of blood relatives. The benefit may be availed provided the gift deed is executed on stamp paper, registered at the office of the sub-registrar, and signed by both parties in the presence of witnesses.

Karnataka

The stamp duty ranges from Rs 1,000 to Rs 5,000, depending on the locality of the property in question. The transfer must be registered at the office of the sub-registrar after submitting property papers, sale deeds, identification documents, or power of attorney. In the case of a transfer to someone outside the family, a fee of 5.6% of the total market value of the property is payable.

Maharashtra

Stamp duty is 3%, which applies if the transferrer and the transferee are blood relatives, and in all other cases Rs. 200 for the residential property or agricultural land. An additional requirement is that registration with local authorities is expected along with the submission of valuation and encumbrance certificates. The rate of stamp duty is 5% in other cases.

Punjab

Stamp duty rates for blood relatives are not more than 0%, while rates for everyone else are fixed at 6%. The procedure involves registering with the sub-registrar, submitting property documents, and completion of legal formalities. The stamp duty payable depends upon the market value of the property.

Rajasthan

Transfer tax is 2.5% among blood relatives and 4% for others. It involves registration with local authorities, document submissions on the properties, and documents related to the act. Commercial properties may be subject to a different basis for calculation.

Tamilnadu

Stamp duty is 1% for transfer between blood relations and 7% for non-family members. The buyer has to provide the property documents, sale deeds, ID proofs, valuation certificates, and encumbrance certificates. Special considerations apply to commercial properties that may differ from the above rates.

West Bengal

Stamp duty on transfers between blood relatives is at 0.5% and for non-family members is at 6%. The process involves registration with the sub-registrar along with necessary property documents and legal paperwork. Also, for properties above Rs 40 lakhs, a 1% surcharge applies.

Gift Deed Registration Charges Based On States

State | Stamp Duty | Exclusive Consideration |

|---|---|---|

Haryana | No stamp duty for gift deeds to blood relatives | Must be executed on stamp paper, registered, and signed with witnesses. |

Karnataka | Rs 1,000 to Rs 5,000; 5.6% for non-family transfers | Registration at the sub-registrar's office is required. |

Maharashtra | 3% for blood relatives; Rs. 200 for residential/agricultural land; 5% otherwise | Registration and submission of valuation & encumbrance certificates required. |

Punjab | 0% for blood relatives; 6% for others | Stamp duty depends on market value; legal formalities must be completed. |

Rajasthan | 2.5% for blood relatives; 4% for others | Commercial properties may have different calculations. |

Tamil Nadu | 1% for blood relatives; 7% for non-family members | Different rates may apply to commercial properties. |

West Bengal | 0.5% for blood relatives; 6% for others | 1% surcharge applies for properties above Rs 40 lakhs. |

Gifting To Blood Relations vs. Non-Relatives

Feature | Gifting to Blood Relations | Gifting to Non-Relatives |

Stamp Duty | Often enjoys reduced stamp duty rates, varying by state and relationship. | Subject to standard stamp duty rates, which are typically higher. |

Tax Implications | Gifts received from blood relatives are generally exempt from income tax under certain conditions of the Income Tax Act. However, Income generated by those gifted assets will still be taxed. | Gifts exceeding a certain monetary value (e.g., ₹50,000 in India) may be taxable as income in the hands of the recipient. |

Legal Considerations | Legal processes are often streamlined due to recognized familial relationships. Specific legal benefits can exist. | Requires standard legal processes for property transfer. Legal formalities are strictly adhered to. |

Emotional Aspect | Often carries significant emotional and familial value, strengthening bonds. | Primarily a legal and financial transaction. |

Property transfer motive. | Often used for familial asset transfer, and estate planning. | Can be for any motive, for example gifts of gratitude, or charitable actions. |

Also Read : Key Differences Between Will and Gift Deed

Tax Consideration For Gift Deed In Blood Relation

Generally, gifts from blood relatives are exempt under subsection 56(2)(x) of the Income Tax Act. Any income will be taxable for the recipient from the gifted asset. Additionally, should the recipient sell this gifted property, they may also be liable for capital gains tax.

Step-by-Step Guide For Gifting Property In Blood Relation With Example

Let's take the example of a father who wishes to gift their property to their son, a blood relative. The procedures are:

- To execute a Gift Deed, a draft must be prepared setting out the details of the father and son, the address of the flat, and a declaration of voluntary transfer.

- Then, purchase stamp paper of the required value as per the state's stamp duty rates for gifts to blood relatives.

- This deed must be signed by the father, son, and two witnesses.

- Then head to the sub-registrar with the original Gift Deed, property documents, and identification proofs for registration.

- Submit the required documents and pay the registration fees, then after verification, the registered Gift Deed can thereafter be collected.

Key Factors Affecting Stamp Duty On Gift Deeds

Such factors include:

- The connection between the donor and donee can make an impact on stamp duty, usually higher for blood relations.

- With the general higher prices of a home, they also go hand in hand with higher stamp duty costs.

- Higher property values generally lead to higher stamp duty costs.

- Within the state, however, the value of the suit can also play a part in determining the stamp duty amount.

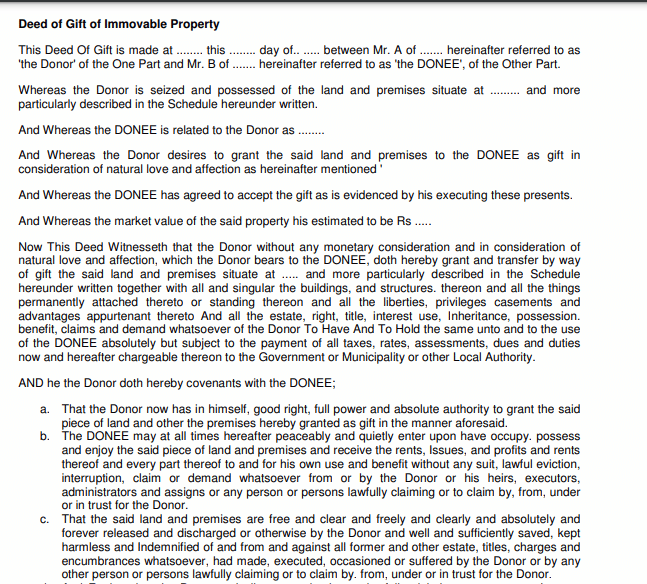

Sample Format Of Gift Deed In Blood Relation

The sample format of a gift deed is as follows:

Related Articles

Key Differences Between Gift Deed And Settlement Deed

How To Challenge A Gift Deed In Court?

Comparison Table: Release Deed vs Gift Deed

How to Transfer Property Title Between Family Members: Step-by-Step Process

Conclusion

A gift deed in blood relation is a legally recognized way to transfer property among family members, ensuring clarity, transparency, and reduced tax liabilities. By following the proper legal process—drafting the deed, paying applicable stamp duty, and registering it with the sub-registrar—you can safeguard your property transfer and avoid future disputes.

Additionally, many states in India offer stamp duty rebates on gift deeds for blood relatives, making it a cost-effective option compared to traditional property transfers. Understanding the legal, financial, and procedural aspects of a gift deed in blood relation can help you make informed decisions while ensuring compliance with state laws.

If you are considering gifting property to a family member, consulting a legal expert can help streamline the process and ensure a smooth transfer of assets.

FAQs

A few FAQs are as follows:

Q1. Is a gift given in a blood relation taxable?

Generally, gifts of movable or immovable property received from blood relatives are exempt from income tax under Section 56(2)(x) of the Income Tax Act. However, income generated from the gifted asset may be taxable in the hands of the donee.

Q2. What is the stamp duty on a GIFT deed in blood relation?

Stamp duty on a Gift Deed in blood relation varies significantly from state to state in India. Many states offer reduced stamp duty rates for gifts made to close blood relatives, such as parents, children, spouses, and siblings. It's crucial to check with the local sub-registrar's office for the most accurate and up-to-date information regarding stamp duty rates in your specific jurisdiction.

Q3. What are the characteristics of a Gift Deed in blood relation?

A Gift Deed in blood relation is characterized by:

- Voluntary Transfer: The transfer of property is made willingly without any consideration.

- Blood Relationship: The transaction occurs between individuals who are related by blood or, in some cases, by marriage.

- Registration: The Gift Deed must be registered to ensure legal validity.

Q4. When can a Gift Deed be revoked?

A Gift Deed can be revoked under specific circumstances, such as:

- Mutual Consent: If both the donor and donee agree to revoke the Gift Deed.

- Fraud or Misrepresentation: If the Gift Deed was executed based on fraud, misrepresentation, or coercion.

- Conditional Gift: If the gift was made with a specific condition that has not been fulfilled.